Bitcoin Chart: Real-Time Price, Historical Data, And Analysis makes the complex world of Bitcoin investing understandable.

Editor's Notes: Bitcoin Chart: Real-Time Price, Historical Data, And Analysis has published today to help target audiences understand the fundamentals of Bitcoin investing.

We’ve gathered information and conducted extensive research to put together this guide to assist you with making informed decisions.

Key differences or Key takeaways:

| Feature | Bitcoin Chart: Real-Time Price, Historical Data, And Analysis |

|---|---|

| Real-time Bitcoin prices | Yes |

| Historical Bitcoin price data | Yes |

| Technical analysis tools | Yes |

| Fundamental analysis tools | Yes |

| Beginner-friendly interface | Yes |

Transition to main article topics:

FAQ

This comprehensive FAQ section aims to address frequently asked questions and clarify any misconceptions regarding Bitcoin and its associated data.

Question 1: What factors influence Bitcoin's price fluctuations?

Bitcoin's price is influenced by a multitude of factors, including demand and supply dynamics, global economic conditions, regulatory changes, news events, technological advancements, and speculative behavior.

bitcoin price chart - Source pdfprof.com

Question 2: How accurate is the historical Bitcoin data provided on this platform?

The historical Bitcoin data presented on this platform is meticulously curated from reputable sources and undergoes rigorous quality checks to ensure accuracy and reliability.

Question 3: Can I use this platform to predict future Bitcoin prices?

While this platform offers a comprehensive analysis of historical and real-time data, it is crucial to note that it cannot accurately predict future Bitcoin prices. Bitcoin's price is inherently volatile and influenced by numerous unpredictable factors.

Question 4: Is it safe to rely on the Bitcoin analysis provided on this platform?

The Bitcoin analysis provided on this platform is based on a combination of technical indicators, market sentiment, and expert insights. While it can be informative, it is important to exercise caution and make informed decisions based on personal research and risk tolerance.

Question 5: How frequently is the Bitcoin data updated?

The Bitcoin data on this platform is updated in real-time to provide the most up-to-date information on price fluctuations, market trends, and other relevant metrics.

Question 6: Who maintains and monitors the quality of the Bitcoin data?

A team of experienced data analysts and Bitcoin experts diligently maintains and monitors the quality of the Bitcoin data on this platform, ensuring its accuracy and consistency.

In summary, this FAQ section provides valuable insights into the factors influencing Bitcoin's price and the reliability of the historical and analytical data presented on this platform. It also emphasizes the importance of making informed decisions based on personal research and understanding the inherent volatility of the cryptocurrency market.

This comprehensive resource aims to empower users with the knowledge and tools necessary to navigate the complexities of Bitcoin and make informed investment decisions.

Tips

Delving into the world of Bitcoin can be a daunting task, especially for beginners. To assist you in navigating this complex landscape, consider the following tips:

Tip 1: Track Bitcoin's Performance: Bitcoin Chart: Real-Time Price, Historical Data, And Analysis provides comprehensive insights into Bitcoin's historical price movements and real-time fluctuations. By monitoring these charts, you can gain a deeper understanding of market trends and make informed trading decisions.

Tip 2: Understand Blockchain Technology: Bitcoin is built upon the innovative blockchain technology. Educating yourself about how blockchain funguje and its implications for Bitcoin's security and immutability is crucial for comprehending the underlying mechanics of the cryptocurrency.

Tip 3: Choose a Reputable Exchange: When engaging in Bitcoin trading, select a reputable and well-established exchange that offers a secure platform, competitive fees, and a wide range of trading options.

Tip 4: Set Realistic Expectations: Bitcoin's value is highly volatile, and its price can fluctuate significantly over short periods. Avoid investing more than you can afford to lose, and set realistic expectations for potential returns.

Tip 5: Secure Your Bitcoin: Safeguarding your Bitcoin involves employing robust security measures, such as using strong passwords, enabling two-factor authentication, and storing your funds in a hardware wallet for enhanced protection.

Tip 6: Stay Informed: The cryptocurrency landscape is constantly evolving. Stay abreast of industry news, regulatory developments, and technological advancements to make informed decisions about your Bitcoin investments.

By implementing these tips, you can navigate the intricacies of Bitcoin trading with greater confidence and potentially maximize your investment outcomes.

Bitcoin Chart: Real-Time Price, Historical Data, And Analysis

Understanding the Bitcoin chart is critical for market analysis. It provides insights into current prices, historical trends, and market sentiment.

10 Big Companies that Hold the Most Bitcoin - Source www.bittime.com

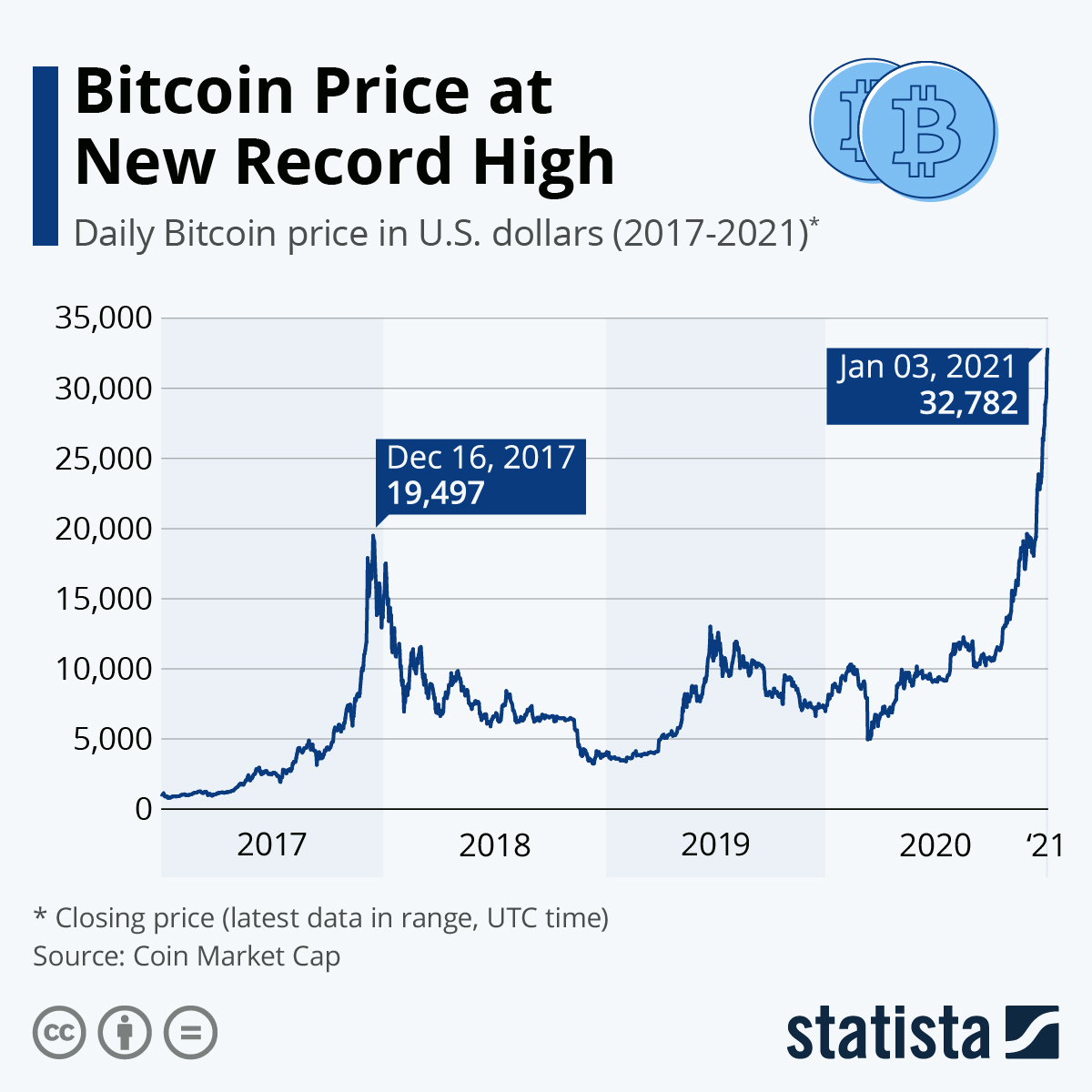

- Time-series data: Historical price movements over time.

- Real-time price: Current market value of Bitcoin.

- Price fluctuations: Changes in Bitcoin's value over time.

- Support and resistance levels: Price points where buying or selling pressure is concentrated.

- Technical indicators: Mathematical formulas used to identify market trends.

- Trading volume: Amount of Bitcoin bought and sold within a given period.

These key aspects collectively paint a comprehensive picture of Bitcoin's market behavior. Real-time price provides immediate insights into market sentiment, while historical data enables trend analysis. Price fluctuations help identify market volatility, and support and resistance levels can predict potential price movements. Technical indicators support decision-making, and trading volume indicates market activity. Understanding these aspects empowers investors to make informed trading decisions and navigate the volatile Bitcoin market.

Bitcoin Price Falling And Rising Trend With Candle Chart Trading Graph - Source cartoondealer.com

Bitcoin Chart: Real-Time Price, Historical Data, And Analysis

The Bitcoin chart is a valuable tool for understanding the cryptocurrency's price movements. It provides real-time data on the current price of Bitcoin, as well as historical data on its price over time. This information can be used to analyze the market and make informed trading decisions.

What Is Bitcoin Halving & How Does It Affect BTC Price? | Crypto.com - Source crypto.com

The Bitcoin chart is also important for tracking the overall health of the cryptocurrency market. When the price of Bitcoin is rising, it is often a sign that the market is bullish and that other cryptocurrencies are also performing well. Conversely, when the price of Bitcoin is falling, it is often a sign that the market is bearish and that other cryptocurrencies are also struggling.

Understanding the connection between the Bitcoin chart and the overall health of the cryptocurrency market is essential for anyone who wants to trade cryptocurrencies successfully.

Conclusion

The Bitcoin chart is a valuable tool for understanding the cryptocurrency's price movements and the overall health of the cryptocurrency market. It can be used to analyze the market and make informed trading decisions.

Traders should be aware of the factors that can affect the price of Bitcoin, such as news events, regulatory changes, and changes in the global economy. By understanding these factors, traders can make more informed decisions about when to buy and sell Bitcoin.