Editor's Notes: "Tesla Stock: A Comprehensive Guide To The Electrifying Rise And Volatility" has published today date. Tesla is a leading electric car maker and its stock has been on a wild ride in recent years. This guide will provide you with everything you need to know about Tesla stock, including its history, performance, and future prospects.

We've done the analysis, dug through the data, and put together this guide to help you make informed decisions about Tesla stock.

Key differences or Key takeways, provide in informative table format

Transition to main article topics

FAQs

A comprehensive exploration of frequently asked questions regarding Tesla's stock performance.

What Tesla Stock’s 50% Decline Means for the Market | Morningstar - Source www.morningstar.com

Question 1: Why has Tesla's stock faced heightened volatility?

The stock's price oscillations stem from various factors, including market sentiment, production challenges, regulatory changes, and the competitive dynamics of the electric vehicle industry.

Question 2: What are the key drivers behind Tesla's stock surge?

Fueled by technological advancements, innovation, and a growing consumer appetite for electric vehicles, the stock's upward trajectory is primarily attributed to Tesla's leading position in the EV market and its broader mission to accelerate the transition to sustainable energy.

Question 3: Are there any risks associated with investing in Tesla stock?

While Tesla's potential for growth is significant, it is not without risks. These include production delays, regulatory headwinds, competition, and the volatile nature of the stock market.

Question 4: What is the company's strategy for sustaining its growth?

Tesla's growth strategy encompasses continuous product innovation, expanding its manufacturing capacity, enhancing its software capabilities, and exploring new markets.

Question 5: What are the potential long-term implications of Tesla's stock performance?

Analysts speculate that sustained growth and increased profitability could propel Tesla's stock to even greater heights. However, volatility is likely to persist, influenced by external factors and the company's own developments.

Question 6: What factors should investors consider when making decisions about Tesla stock?

Investors are advised to carefully assess the company's fundamentals, market trends, industry competition, and their own risk tolerance before making investment decisions.

By addressing these frequently asked questions, we aim to provide a comprehensive understanding of Tesla's stock dynamics and assist investors in making informed decisions.

Transition to the next article section.

Tips

If you're thinking about investing in Tesla stock, there are a few things you should keep in mind. Here are five tips to help you make the most of your investment:

Why Tesla Stock Can Survive the Coronavirus Scare - Source marketrealist.com

Tip 1: Do your research.

Before you buy any stock, it's important to do your research and understand the company. Tesla Stock: A Comprehensive Guide To The Electrifying Rise And Volatility is a good place to start, but there are many other resources available online. The more you know about Tesla, the better equipped you'll be to make informed investment decisions.

Tip 2: Consider your investment horizon.

Tesla is a volatile stock, so it's important to consider your investment horizon before you buy. If you're looking for a short-term investment, Tesla may not be the right choice for you. However, if you're willing to hold on to your investment for the long term, Tesla has the potential to be a very rewarding investment.

Tip 3: Diversify your portfolio.

Don't put all your eggs in one basket. Diversify your portfolio by investing in a variety of stocks, bonds, and other assets. This will help to reduce your overall risk.

Tip 4: Don't panic sell.

Tesla stock is volatile, so it's important to stay calm if the stock price drops. Panicking and selling your stock at a loss is one of the worst things you can do. Instead, focus on the long term and ride out the volatility.

Tip 5: Get professional advice.

If you're not sure how to invest in Tesla stock, get professional advice from a financial advisor. A financial advisor can help you create a personalized investment plan that meets your individual needs.

Investing in Tesla stock can be a great way to grow your wealth, but it's important to do your research and understand the risks. By following these tips, you can help to increase your chances of success.

For more information, please refer to the article Tesla Stock: A Comprehensive Guide To The Electrifying Rise And Volatility.

Tesla Stock: A Comprehensive Guide To The Electrifying Rise And Volatility

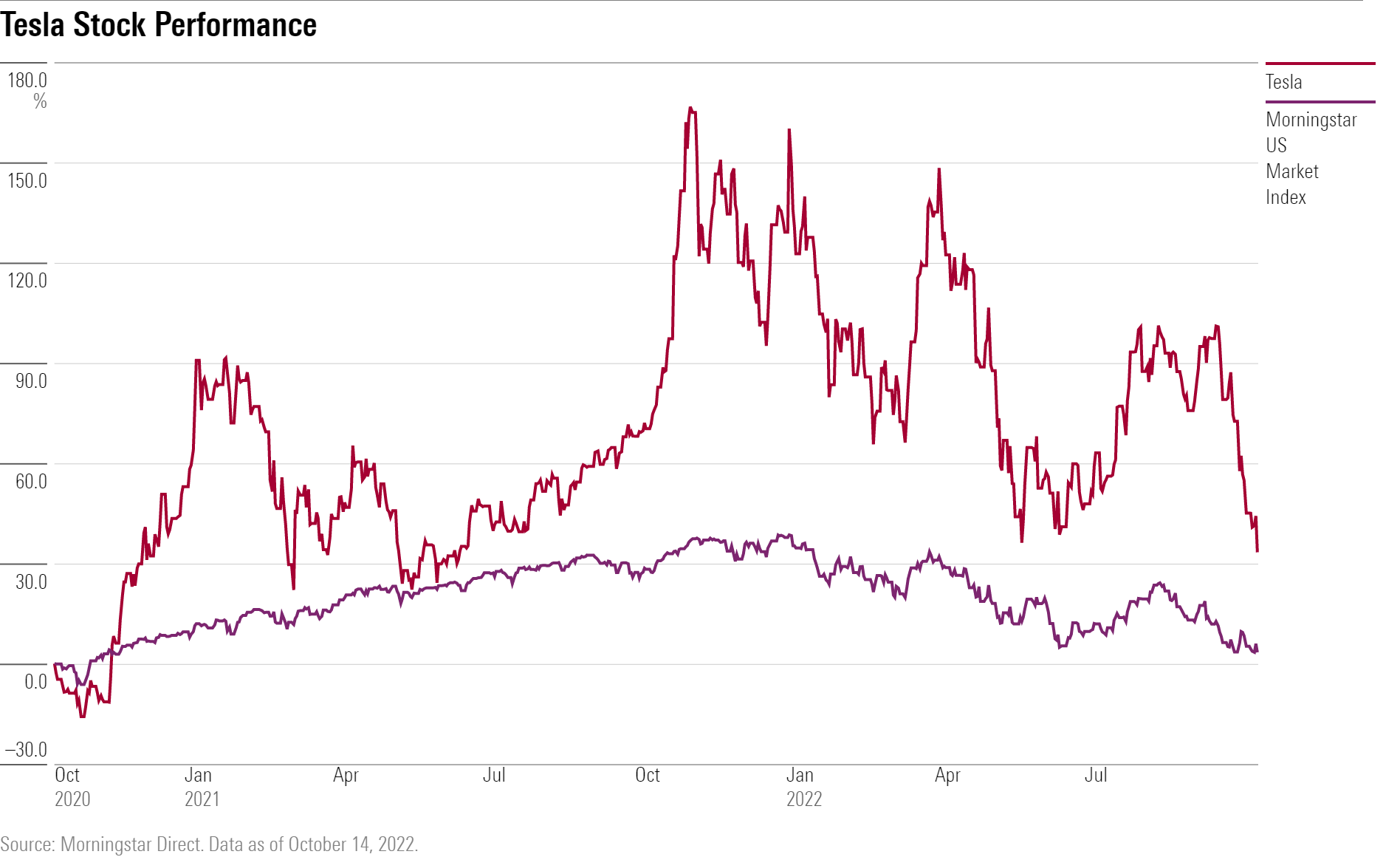

Tesla stock has experienced remarkable growth and significant volatility since its initial public offering (IPO) in 2010. This guide explores six key aspects that have shaped its electrifying rise and volatility, providing insights into factors driving its performance and challenges it has faced.

- Innovation and Technology: Tesla's groundbreaking electric vehicles (EVs) and advanced battery technology have set new industry standards.

- Demand and Competition: Growing demand for EVs, coupled with increasing competition from established automakers, has influenced Tesla's market share and pricing dynamics.

- Elon Musk: The company's charismatic CEO, Elon Musk, has had a profound impact on Tesla's image, strategy, and stock price fluctuations.

- Production and Supply Chain: Tesla's ambitious production targets and complex global supply chain have contributed to challenges and opportunities for the company.

- Financial Performance: Tesla's revenue, profitability, and cash flow have shown significant growth in recent years, but fluctuations in these metrics have also affected stock performance.

- Investor Sentiment: The highly speculative nature of Tesla stock, driven by factors such as its growth potential and Musk's influence, has contributed to its volatility.

These key aspects are interconnected and have played a crucial role in shaping Tesla stock's performance. For example, Tesla's technological advancements have fueled demand and driven innovation, while production challenges have impacted supply and affected investor sentiment. Elon Musk's public statements and controversial actions have also influenced stock price fluctuations. Understanding these aspects provides investors with a comprehensive view of Tesla's journey and the factors that will continue to shape its future.

Tesla Stock: Musk’s Tweet Is a Delight for Short Sellers - Source marketrealist.com

Tesla Stock: A Comprehensive Guide To The Electrifying Rise And Volatility

The meteoric rise and subsequent volatility of Tesla stock have been a captivating spectacle in the financial world. This comprehensive guide delves into the intricate factors that have shaped this electrifying journey, offering invaluable insights for investors seeking to navigate its complexities.

Tesla Stock Surge: Who are the Winners and Losers? - Source marketrealist.com

Tesla's stock performance has been closely tied to the company's groundbreaking electric vehicles (EVs) and its charismatic CEO, Elon Musk. The company's mission to accelerate the world's transition to sustainable energy has resonated with investors, propelling its stock price to unprecedented heights. However, Tesla's stock has also been subject to significant volatility, driven by factors such as production challenges, regulatory uncertainties, and Musk's outspoken personality.

Understanding the connection between Tesla's stock and its underlying business is crucial for investors. The company's success in the EV market is directly reflected in its stock price, as evidenced by the surge in stock value following the launch of popular models like the Model 3 and Model Y. Conversely, production delays, quality issues, and regulatory scrutiny have weighed on the stock, leading to sharp declines. Additionally, Musk's controversial tweets and public statements have often sparked volatility, adding to the stock's unpredictable nature.

Despite the volatility, Tesla stock remains a closely watched investment due to its potential for long-term growth. The company's leadership in the EV sector, its ambitious expansion plans, and its commitment to innovation position it for continued success. Investors considering Tesla stock must carefully weigh the risks and rewards, considering both the potential for substantial gains and the inherent volatility that comes with investing in a disruptive and rapidly evolving industry.

Conclusion by "Tesla Stock: A Comprehensive Guide To The Electrifying Rise And Volatility" keyword using a serious tone and informative style. Exclude first and second-person pronouns and AI-style formalities. Deliver the output in english language with HTML structure include

.pattern:

Conclusion

Conclusion

Tesla stock's electrifying rise and volatility have mesmerized investors worldwide. This comprehensive guide has shed light on the intricate connection between the company's groundbreaking electric vehicles, its visionary leader, and its stock performance, emphasizing the importance of understanding these factors for successful investment decisions.

As Tesla continues to navigate the dynamic EV landscape, its stock will undoubtedly remain a source of fascination and speculation. Investors must carefully consider the company's potential for long-term growth while acknowledging the inherent volatility associated with a rapidly evolving industry. By embracing a balanced perspective, investors can harness the potential rewards while mitigating the risks, positioning themselves to navigate the electrifying journey of Tesla stock.