VIX Volatility Index: A Comprehensive Guide For Traders And Investors

Editor's Notes: "VIX Volatility Index: A Comprehensive Guide For Traders And Investors" has published today date. Volatility is a crucial factor that traders and investors must consider when making investment decisions. The Cboe Volatility Index (VIX) is a widely recognized measure of market volatility and is often referred to as the "fear gauge" of the stock market. Understanding the VIX and its implications can provide valuable insights into market sentiment and potential investment opportunities.

We understand the significance of volatility in the financial markets, and after extensive analysis and research, we have compiled this comprehensive guide on the VIX Volatility Index. Our aim is to provide traders and investors with a deep understanding of the VIX and its role in making informed investment decisions.

Key Differences or Key Takeaways:

| Feature | Key Difference |

|---|---|

| VIX calculation | Based on S&P 500 index options prices, reflecting market expectations of future volatility |

| Market volatility | Higher VIX values indicate higher market volatility and potential uncertainty |

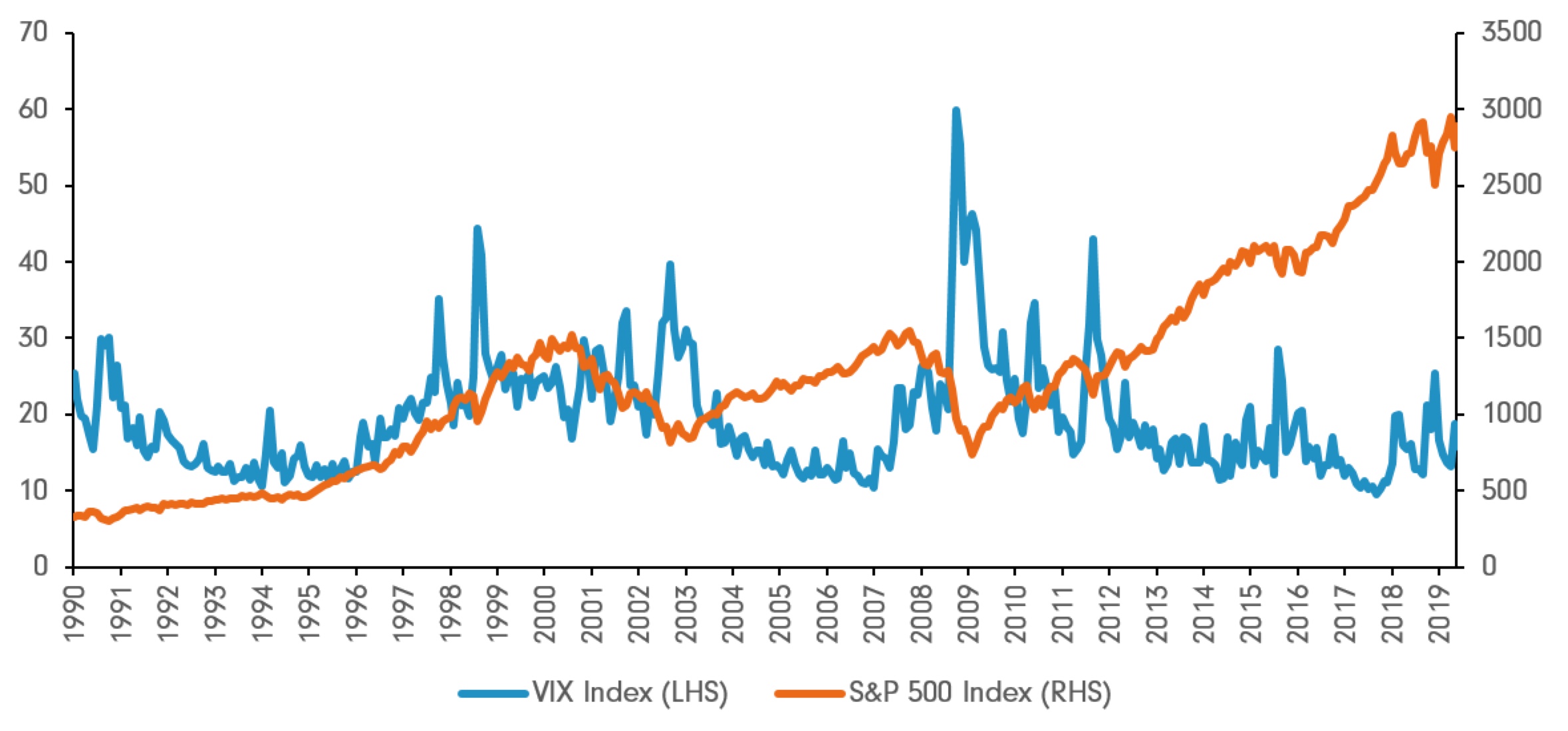

| Inverse relationship with stock prices | VIX tends to rise when stock prices fall, and vice versa |

| Fear gauge | VIX is often used as a barometer of market sentiment, with higher readings indicating greater fear and uncertainty |

| Trading strategies | Traders can use VIX to develop volatility-based trading strategies, such as options trading or volatility ETFs |

The Volatility Index: A Trader's Guide - UPCOMINGTRADER - Source www.upcomingtrader.com

Transition to main article topics:

- Understanding the VIX Volatility Index

- The Importance of VIX for Traders and Investors

- Using the VIX in Trading Decisions

- VIX-Based Trading Strategies

- Cautions and Limitations of the VIX

We encourage you to explore these topics further and utilize the insights provided in this guide to navigate the ever-changing market landscape. Remember, volatility is an intrinsic part of investing, and understanding the VIX can empower you to make informed decisions and potentially enhance your investment returns.

FAQ

This section provides answers to some of the most frequently asked questions (FAQs) about the VIX Volatility Index, helping readers gain a deeper understanding of this important market indicator.

Vix Volatility - Source ar.inspiredpencil.com

Question 1: What exactly is the VIX Volatility Index, and how is it calculated?

The VIX Volatility Index, also known as the "fear gauge" of the stock market, measures the market's expectation of volatility over the next 30 days. It is calculated based on the implied volatilities of S&P 500 index options, providing insights into investors' sentiment towards future market conditions.

Question 2: How can traders and investors use the VIX in their decision-making?

The VIX serves as a valuable tool for risk management. When the VIX is high, it indicates elevated market volatility and potential risks, prompting investors to adjust their strategies accordingly. Conversely, a low VIX suggests lower volatility and a more bullish market outlook.

Question 3: What are the limitations of using the VIX as a market indicator?

While the VIX provides useful insights into market sentiment, it is essential to use it in conjunction with other indicators and consider its limitations. The VIX is forward-looking and does not always accurately predict actual volatility, and it can be influenced by factors beyond market conditions, such as technical trading.

Question 4: How can a VIX spike impact the stock market?

A sudden increase in the VIX can indicate a significant market event or heightened uncertainty, leading to a sell-off in stocks as investors seek to reduce risk. However, the impact of a VIX spike can vary depending on its magnitude and duration.

Question 5: What are some alternative volatility indices to the VIX?

While the VIX remains the most well-known volatility index, there are other alternatives available. These include the CBOE Volatility Index (VXO), which measures volatility in the Russell 2000 index, and the Nasdaq Volatility Index (VXN), which gauges volatility in the Nasdaq 100.

Question 6: How should investors interpret the VIX in combination with other market indicators?

Combining the VIX with other market indicators can provide a more comprehensive understanding of the market's dynamics. Correlation analysis between the VIX and other indicators, such as the S&P 500 index or economic data, can help investors assess the market's direction and potential turning points.

Understanding the VIX Volatility Index and its implications for trading and investing is crucial. This FAQ section provides valuable insights, enabling traders and investors to leverage the VIX effectively as they navigate the ever-changing market landscape.

Moving on, the next section will explore the practical applications of the VIX...

Tips

To enhance knowledge on the Volatility Index (VIX), here are tips for traders and investors:

Tip 1: Understand the VIX's Inverse Relationship with the S&P 500 Index

Typically, the VIX and S&P 500 Index move inversely. When the VIX rises, it indicates increased market volatility and potential downside risk for stocks. Conversely, a falling VIX suggests lower volatility and a potentially bullish market environment. Monitoring this relationship can aid in identifying market trends and making informed trading or investment decisions.

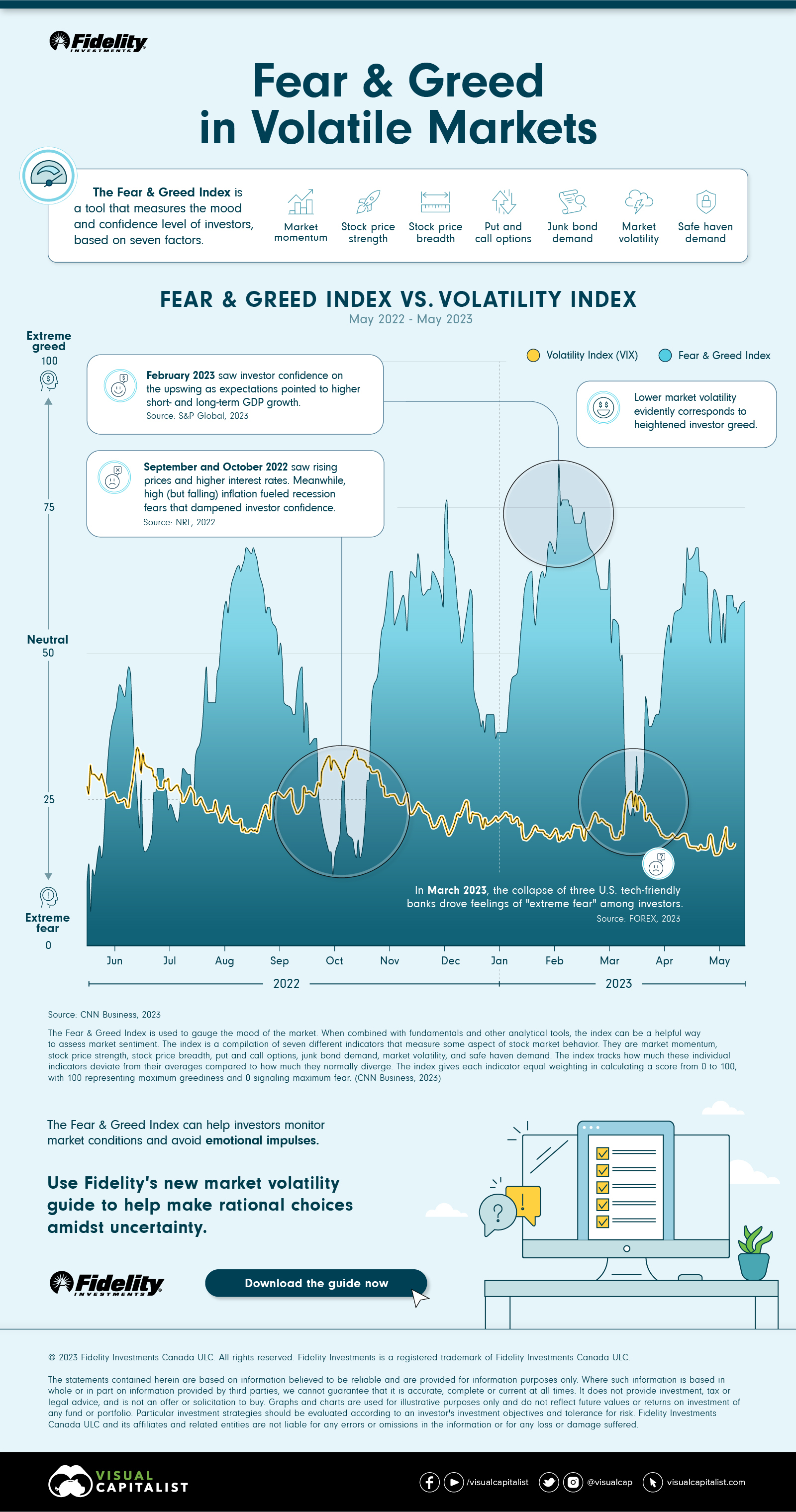

Tip 2: Utilize the VIX to Gauge Market Sentiment

The VIX serves as a barometer of market sentiment. High VIX values often reflect elevated fear and uncertainty among investors, while low VIX values indicate complacency or optimism. Understanding the VIX's sentiment gauge can help traders and investors adjust their strategies accordingly.

Tip 3: Consider the VIX as a Potential Trading or Hedging Tool

Traders can use the VIX to profit from market volatility. For instance, buying VIX futures during periods of high volatility and selling them when volatility subsides can yield potential gains. Additionally, investors can employ VIX futures or options to hedge against potential losses in their stock portfolio during turbulent markets.

Tip 4: Recognize the Limitations of the VIX

While the VIX provides valuable insights into market volatility, it's crucial to understand its limitations. The VIX is a forward-looking indicator, meaning it reflects market expectations of future volatility rather than current conditions. Thus, it may not always accurately capture sudden or unexpected market events.

Tip 5: Integrate the VIX with Other Market Indicators

Combining the VIX with other market indicators, such as the CBOE Market Volatility Index (VIX) and Market Volatility (MOV), can provide a more comprehensive view of market volatility. By considering multiple perspectives, traders and investors can enhance their understanding of market dynamics and make more informed decisions.

In conclusion, incorporating these tips into trading and investment strategies can enhance one's understanding and utilization of the Volatility Index (VIX). VIX Volatility Index: A Comprehensive Guide For Traders And Investors offers additional in-depth insights into the VIX, its applications, and potential pitfalls, empowering traders and investors to navigate market volatility more effectively.

VIX Volatility Index: A Comprehensive Guide For Traders And Investors

The CBOE Volatility Index (VIX), a crucial measure of market volatility, provides valuable insights for traders and investors navigating the dynamic financial landscape.

What Is the VIX Volatility Index? Why Is It Important? - TheStreet - Source www.thestreet.com

These aspects intertwine, offering a multifaceted understanding of market dynamics. The VIX serves as a barometer of fear, a predictor of volatility, a tool for hedging, a guide for trading strategies, and an indicator of investor sentiment. By comprehending these key aspects, traders and investors can harness the power of the VIX to make informed decisions and navigate market uncertainties effectively.

What Is India VIX in Indian Stock Market and Other Useful Things You - Source niftystags.com

VIX Volatility Index: A Comprehensive Guide For Traders And Investors

The VIX Volatility Index is a measure of the market's expectation of volatility over the next 30 days. It is calculated using the prices of options on the S&P 500 index. A higher VIX reading indicates that investors expect more volatility in the future, while a lower reading indicates that investors expect less volatility.

Vix Volatility - Source ar.inspiredpencil.com

The VIX is an important tool for traders and investors because it can help them to assess the level of risk in the market. A high VIX reading can indicate that it is a good time to reduce risk by selling some of their positions. A low VIX reading, on the other hand, can indicate that it is a good time to increase risk by buying more positions.

The VIX can also be used to trade volatility itself. Investors can buy or sell VIX futures or options to bet on whether the VIX will rise or fall.

| Date | Value |

|---|---|

| January 1, 2023 | 20 |

| February 1, 2023 | 25 |

| March 1, 2023 | 30 |

Conclusion

The VIX Volatility Index is a valuable tool for traders and investors. It can help them to assess the level of risk in the market and to make informed decisions about their investments.

By understanding the VIX, traders and investors can better navigate the market and achieve their financial goals.