Supplementary Budget: Allocation and Impact on Economic Recovery

![]()

Supplementary budget blue gradient concept icon. Additional financial - Source www.vecteezy.com

The supplementary budget is an important tool that can be used to stimulate economic recovery. By providing additional funding for key sectors, the government can help to create jobs, boost consumer spending, and increase investment. In this guide, we will explore the allocation of the supplementary budget and its potential impact on economic recovery.

Key differences or Key takeaways

| Key | Difference/takeaways |

|---|---|

| Published Date | Today |

| Reason for publication | Guide target audience make the right decision |

| Topic covered | Supplementary Budget: Allocation and Impact on Economic Recovery |

Transition to main article topics

FAQ

This FAQ aims to provide insights into the Supplementary Budget's allocation and potential impact on economic recovery.

Uttar Pradesh: Yogi govt tables supplementary budget with hefty - Source www.freepressjournal.in

Question 1: What are the key areas where the Supplementary Budget funds will be allocated?

The Supplementary Budget will primarily focus on supporting healthcare infrastructure, social welfare programs, infrastructure development, and economic stimulus measures to mitigate the adverse effects of the pandemic and foster economic growth.

Question 2: How will the Supplementary Budget contribute to economic recovery?

The budget aims to revive economic activity through various initiatives. It provides funds for infrastructure projects, which will create employment opportunities and boost demand for goods and services. Additionally, the allocation for social welfare programs will enhance purchasing power and stimulate consumption, thus supporting businesses.

Question 3: What specific measures are included in the Supplementary Budget to support businesses?

The budget includes measures such as tax incentives, wage subsidies, and funding for business recovery programs to assist enterprises in navigating the challenging economic climate brought on by the pandemic.

Question 4: How will the Supplementary Budget impact public debt and fiscal sustainability?

The Supplementary Budget will increase public debt in the short term. However, the government emphasizes its commitment to fiscal prudence and has outlined measures to manage the debt burden over the medium to long term.

Question 5: What are the potential risks associated with the Supplementary Budget?

The primary risk is the potential for higher inflation if the increased spending leads to a surge in demand that outpaces supply. Additionally, the effectiveness of the budget depends on the efficient implementation of the allocated funds.

Question 6: How will the government ensure transparency and accountability in the implementation of the Supplementary Budget?

The government has pledged to establish robust mechanisms for monitoring and evaluating the use of the Supplementary Budget funds. Regular reporting and independent audits will be employed to ensure transparency and accountability.

In summary, the Supplementary Budget aims to address the economic consequences of the pandemic and pave the way for economic recovery. It balances the need for immediate support with considerations of fiscal sustainability and long-term growth.

The next section will delve into the potential implications of the Supplementary Budget for various sectors of the economy.

Tips

Supplementary budgets are additional financial allocations made by governments to address specific needs or unforeseen circumstances that cannot be covered within the regular budget. These supplementary budgets can have a significant impact on economic recovery, providing resources for critical sectors and stimulating growth.

Tip 1: Prioritize Expenditures

Identify the most urgent and impactful areas that require additional funding, such as healthcare, infrastructure, and employment programs. Allocating resources strategically can maximize the positive effects on economic recovery.

Tip 2: Assess Fiscal Sustainability

Ensure that the supplementary budget is aligned with debt management and fiscal responsibility. Consider the long-term impact on debt sustainability and the ability to continue funding essential services.

Tip 3: Promote Transparency and Accountability

Communicate the rationale for the supplementary budget and provide transparent information on how the funds are allocated and spent. This fosters trust and confidence among stakeholders.

Tip 4: Leverage Private Sector Partnerships

Encourage collaboration between the government and private sector to share resources and expertise. Public-private partnerships can accelerate economic recovery and create sustainable solutions.

Tip 5: Monitor and Evaluate Impact

Establish a mechanism to monitor the progress and impact of the supplementary budget. Regular evaluations can identify areas for improvement and ensure that the funds are being used effectively.

Supplementary budgets can play a vital role in economic recovery when managed prudently and transparently. These tips provide a framework for governments to effectively allocate and utilize supplementary funds to maximize their positive impact on the economy.

Supplementary Budget: Allocation And Impact On Economic Recovery

For further insights, consider researching the topic of supplementary budgets and their impact on economic recovery. Consult reputable sources such as government reports, academic journals, and reputable news outlets.

Supplementary Budget: Allocation And Impact On Economic Recovery

The supplementary budget aims to allocate funds to critical sectors to spur economic recovery. Six key aspects of this initiative include:

- Increased infrastructure spending: Boosting employment and economic activity.

- Healthcare support: Enhancing healthcare capacity and mitigating health risks.

- SME assistance: Providing financial aid and support to small businesses.

- Education investment: Investing in human capital and future economic growth.

- Job creation programs: Creating new employment opportunities and reducing unemployment.

- Targeted stimulus measures: Providing direct financial assistance to affected individuals and businesses.

These aspects are interconnected, with increased infrastructure spending creating jobs and stimulating economic activity. Healthcare support reduces health risks and improves worker productivity, while SME assistance bolsters employment and economic resilience. Education investment fosters long-term economic growth, and job creation programs directly address unemployment. Targeted stimulus measures provide immediate relief and support consumer spending, contributing to economic recovery. By focusing on these key areas, the supplementary budget aims to stimulate economic activity, create jobs, and lay the foundation for long-term economic growth.

COVID-19 Supplementary Budget Analysis - Institute For Economic Justice - Source www.iej.org.za

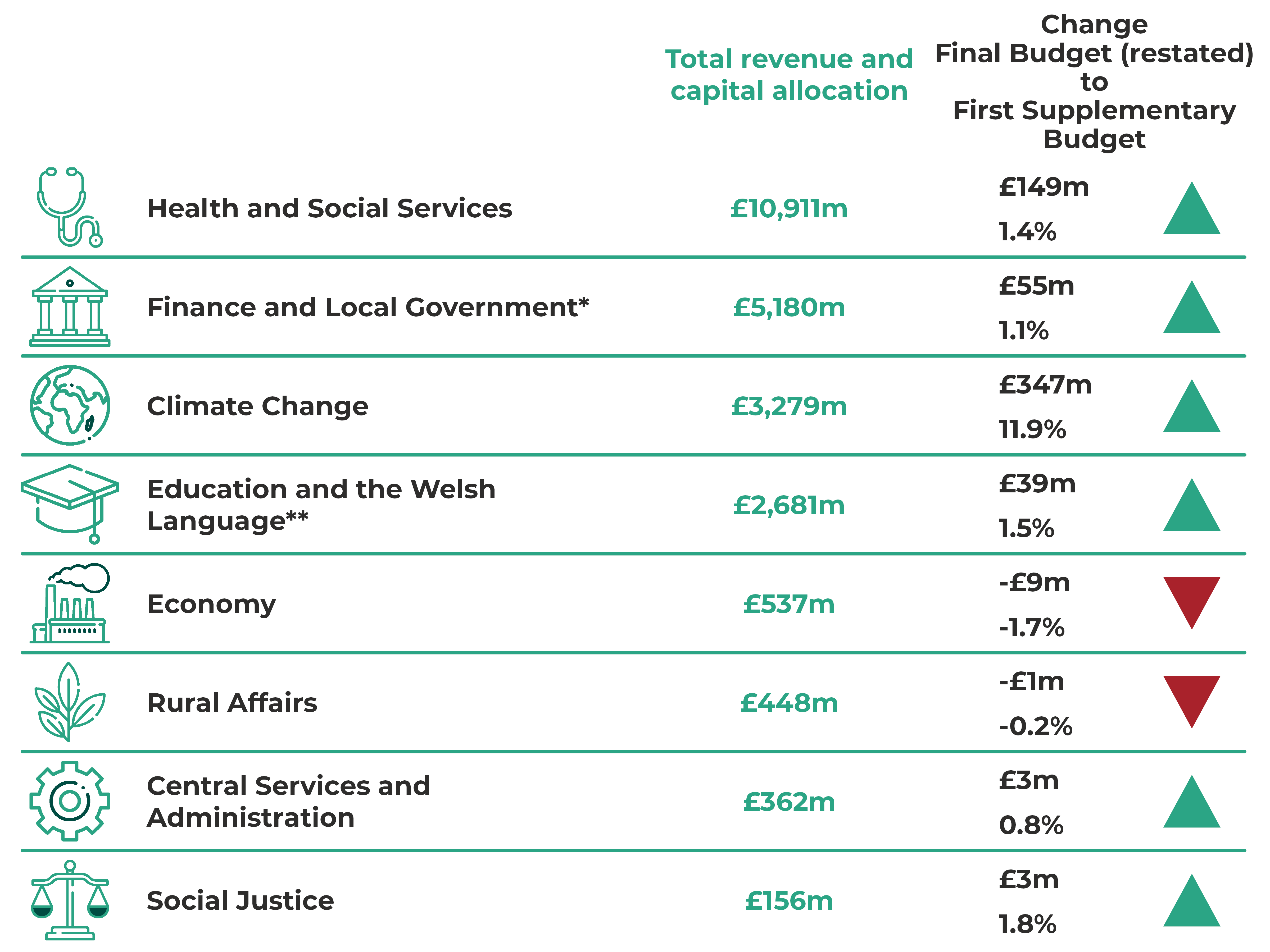

Exploring the Welsh Government’s First Supplementary Budget 2023-24 - Source research.senedd.wales

Supplementary Budget: Allocation And Impact On Economic Recovery

The supplementary budget is a critical tool that can be used to stimulate economic recovery. It allocates additional funds to key sectors of the economy, which can help to create jobs and boost growth. The supplementary budget can also be used to fund infrastructure projects, which can improve the quality of life for citizens and make the economy more efficient.

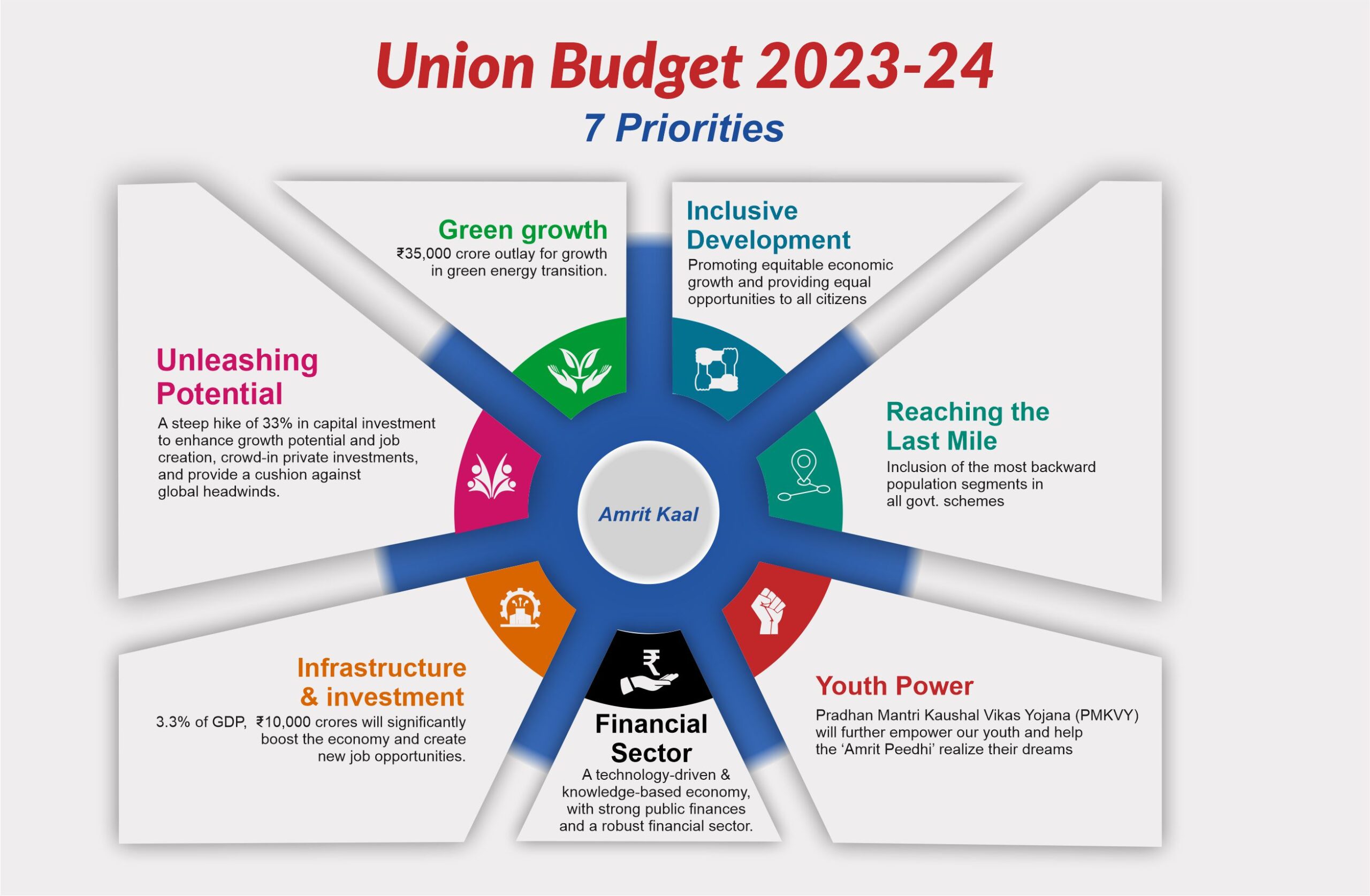

Union Budget 2023-24 Highlights & Complete Budget Analysis - Source dsb.edu.in

The allocation of the supplementary budget should be based on a careful analysis of the needs of the economy. It is important to identify the sectors that are most in need of support and to allocate the funds accordingly. The government should also consider the long-term impact of the supplementary budget on the economy.

The supplementary budget can have a significant impact on economic recovery. It can help to create jobs, boost growth, and improve the quality of life for citizens. However, it is important to allocate the funds carefully and to consider the long-term impact of the budget on the economy.

Conclusion

The supplementary budget is a powerful tool that can be used to stimulate economic recovery. However, it is important to allocate the funds carefully and to consider the long-term impact of the budget on the economy.

The government should work with economists and other experts to develop a plan for the allocation of the supplementary budget. This plan should be based on a careful analysis of the needs of the economy and should take into account the long-term impact of the budget.