The Nikkei Average: A Real-Time Stock Market Index for Japanese Equities

Premium AI Image | A digital billboard at an airport terminal showing a - Source www.freepik.com

Editor's Note: The Nikkei Average: Real-Time Stock Market Index for Japanese Equities is a critical tool for investors and market analysts interested in the Japanese stock market, providing valuable insights into the performance of the country's leading companies.

Our team of experts has analyzed and compiled this comprehensive guide to help you understand the Nikkei Average, its significance, and how it can inform your investment decisions.

Key Takeaways:

| Feature | Description |

|---|---|

| Real-Time Data | Provides up-to-date information on the performance of Japanese stocks. |

| Market Benchmark | Serves as a benchmark for tracking the overall health of the Japanese economy. |

| Global Relevance | Monitors the performance of leading Japanese companies with significant global reach. |

Main Article Topics:

FAQ

This extensive FAQ section addresses common inquiries and misconceptions regarding the Nikkei Average, providing a comprehensive knowledge base about this crucial stock market index for Japanese equities.

Japanese stock market miracle more financial than real | East Asia - Source www.eastasiaforum.org

Question 1: What is the Nikkei Average?

The Nikkei Average, also known as the Nikkei 225, is a price-weighted stock market index that measures the performance of the 225 most prominent companies listed on the Tokyo Stock Exchange (TSE).

Question 2: How is the Nikkei Average calculated?

The Nikkei Average is calculated by taking the sum of the closing prices of the 225 constituent companies and dividing it by the Nikkei divisor. The divisor adjusts for stock splits and other corporate actions, ensuring the index remains comparable over time.

Question 3: What factors influence the Nikkei Average?

Various economic and financial factors can impact the Nikkei Average, including corporate earnings, economic growth, interest rates, and global market sentiment.

Question 4: What is the significance of the Nikkei Average?

The Nikkei Average is widely recognized as a benchmark for the Japanese stock market and a barometer of the overall economic health of Japan. It serves as an investment benchmark and a reference point for financial analysts.

Question 5: How can investors use the Nikkei Average?

Investors can use the Nikkei Average to gain insights into the Japanese stock market, make informed investment decisions, and track the overall performance of their portfolios.

Question 6: Where can I find the latest Nikkei Average data?

Real-time Nikkei Average data is readily available on various financial news websites, market data providers, and the Tokyo Stock Exchange website.

In summary, the Nikkei Average remains a cornerstone of Japanese financial markets, providing valuable insights into the performance of the Tokyo Stock Exchange and the broader Japanese economy.

For more in-depth information and analysis, consult reliable sources such as financial news outlets and market research firms.

Tips on Nikkei Average: Real-Time Stock Market Index For Japanese Equities

Premium AI Image | A graph showing the upward trend of a stock market - Source www.freepik.com

The Nikkei Average, widely known as the Nikkei 225, is the leading stock market index for Japanese equities. It comprises the 225 most traded companies on the Tokyo Stock Exchange's First Section.

Tip 1: Track market performance: The Nikkei Average serves as a barometer for the overall health of the Japanese stock market, providing insights into economic conditions and investor sentiment.

Tip 2: Identify industry trends: The index is categorized into various sectors, enabling investors to gauge the performance of specific industries and identify growth opportunities.

Tip 3: Monitor company performance: The Nikkei Average constituents are selected based on factors such as market capitalization and trading volume, providing a snapshot of the performance of leading Japanese companies.

Tip 4: Assess risk exposure: The Nikkei Average can be used as a basis for comparing the risk-return profile of different Japanese investments, helping investors manage risk.

Tip 5: Make informed investment decisions: By analyzing the Nikkei Average and its components, investors can gain valuable insights for making informed decisions about their Japanese equity investments.

To enhance your understanding of the Nikkei Average, consider consulting credible sources for further research.

Nikkei Average: Real-Time Stock Market Index For Japanese Equities

The Nikkei Average, a prominent indicator of Japanese stock market performance, offers invaluable insights into the economic health of Japan and the broader Asia-Pacific region. Its composition and real-time nature make it an essential tool for investors, analysts, and policy-makers.

- Market Barometer: Reflects overall market sentiment and economic conditions.

- Blue-Chip Representation: Comprised of 225 leading Japanese companies across key sectors.

- Historical Significance: Calculated since 1949, providing a long-term perspective on market trends.

- Global Influence: Widely used to assess global market performance and economic outlook.

- Real-Time Data: Updated throughout the trading day, enabling timely investment decisions.

- Economic Indicator: Serves as an early indicator of Japan's economic growth and stability.

3D Smartphone with graph chart buy and sell shares, stock market index - Source www.vecteezy.com

The Nikkei Average's comprehensive nature makes it a valuable tool for assessing market dynamics. Its real-time data provides investors with up-to-the-minute information, enabling informed investment strategies. Furthermore, its historical significance allows for trend analysis and forecasting, while its global influence highlights the interdependence of world markets. As a key indicator of Japan's economic health, the Nikkei Average remains essential for understanding the performance and direction of one of the world's leading economies.

Index Stock Market: A Comprehensive Guide - Quant Matter - Source quantmatter.com

Nikkei Average: Real-Time Stock Market Index For Japanese Equities

The Nikkei Average, also known as the Nikkei 225, is a stock market index for the Tokyo Stock Exchange (TSE). It is a price-weighted index of the 225 most actively traded companies on the TSE's First Section. The Nikkei Average is a widely followed measure of the Japanese stock market and its performance is often used as a barometer of the overall health of the Japanese economy.

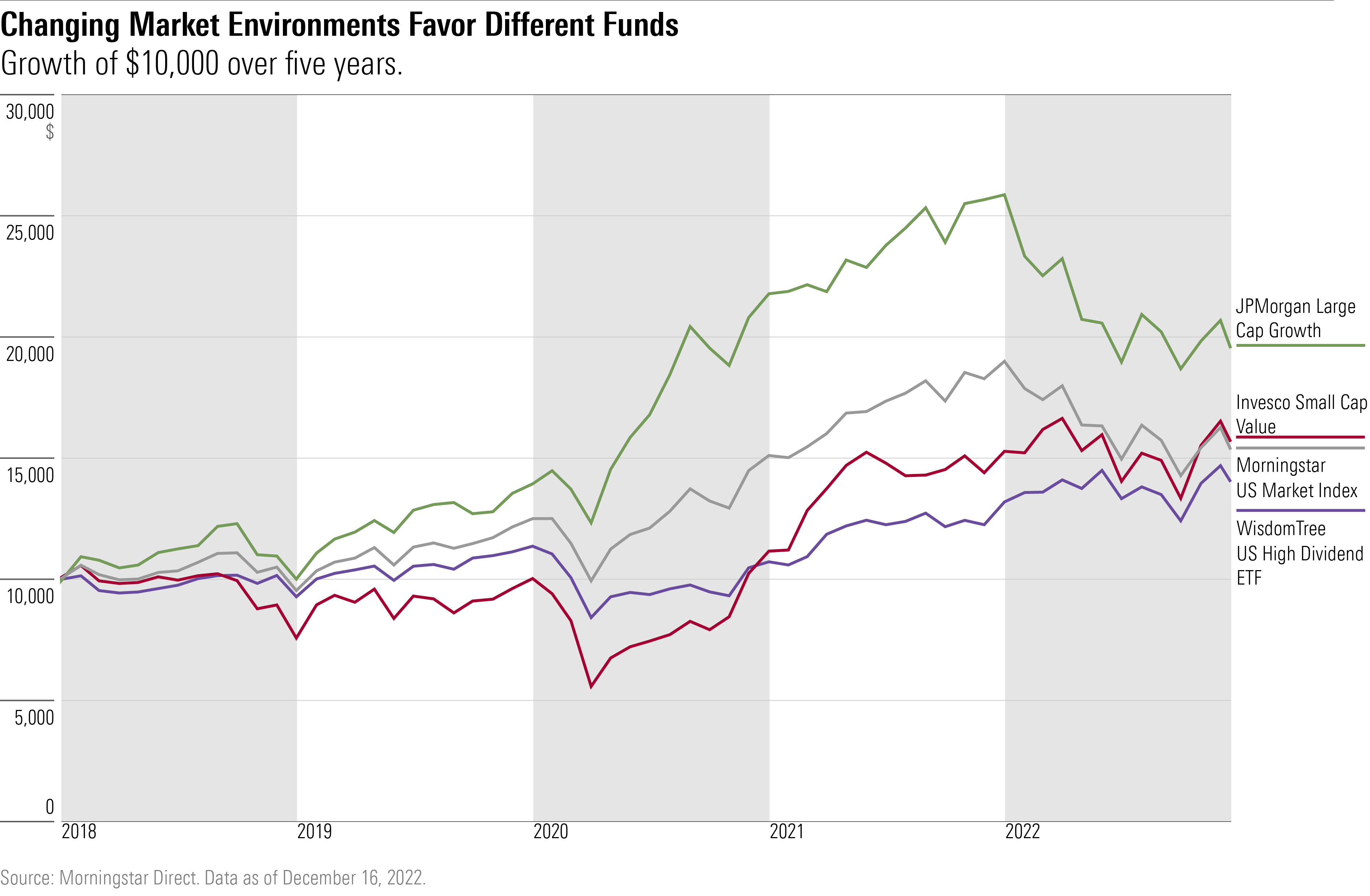

2022’s Best-Performing U.S. Stock Funds | Morningstar - Source www.morningstar.com

The Nikkei Average was created in 1950 by the Nihon Keizai Shimbun (Nikkei), Japan's largest financial newspaper. The index was originally calculated using the prices of all stocks listed on the TSE's First Section, but was later changed to include only the 225 most actively traded companies. The Nikkei Average is calculated in real time and is published every business day at 9:00 AM JST.

The Nikkei Average is an important indicator of the health of the Japanese economy and is widely followed by investors around the world. The index can be used to track the performance of the Japanese stock market and to make investment decisions. The Nikkei Average also provides insights into the overall economic climate in Japan and can be used to identify potential investment opportunities.

Here are some of the key features of the Nikkei Average:

| Feature | Description |

|---|---|

| Index type | Price-weighted |

| Number of companies | 225 |

| Base date | September 18, 1949 |

| Base value | 176.21 |

| Calculation method | The sum of the prices of the 225 component stocks divided by the Nikkei 225 Stock Average Divisor |

Conclusion

The Nikkei Average is a valuable tool for investors and analysts who want to track the performance of the Japanese stock market. The index can be used to make investment decisions, identify potential investment opportunities, and gain insights into the overall economic climate in Japan.

The Nikkei Average is a widely followed index and its performance is often used as a barometer of the overall health of the Japanese economy. The index is also a popular investment vehicle for both domestic and international investors.