Wondering about Nikkei 225 Futures: Trading Strategies And Market Analysis? Our guide summarizes what you need to know about trading Nikkei 225 futures and how to profit from this lucrative market.

Editor's Note: Real-time market updates, effective strategies, and critical factors about Nikkei 225 Futures: Trading Strategies And Market Analysis have published today. This knowledge has been carefully curated to empower our readers to make informed decisions when approaching this market.

Our in-depth analysis, years of experience, and top-of-the-line resources have been carefully put together in this Nikkei 225 Futures: Trading Strategies And Market Analysis guide. Our aim is to provide traders with a comprehensive understanding of this market, enabling them to capitalize on its opportunities

Key differences or Key takeways:

| Futures Contract | Underlying Index | Tick Size | Contract Size | Trading Hours |

|---|---|---|---|---|

| Nikkei 225 Futures | Nikkei 225 | 1 point | 1000 shares | 7:00 AM - 3:00 PM JST |

Transition to main article topics:

- Understanding Nikkei 225 Futures

- Trading Strategies for Nikkei 225 Futures

- Market Analysis for Nikkei 225 Futures

- Tips for Trading Nikkei 225 Futures

- Conclusion

FAQ

This comprehensive FAQ section provides detailed answers to frequently asked questions regarding Nikkei 225 Futures trading strategies and market analysis. By addressing common concerns and misconceptions, this resource aims to enhance your understanding and equip you with the knowledge necessary for successful trading.

Trading Range on Nikkei 225 Dollar Futures for CME:NKD1! by Taomarte - Source www.tradingview.com

Question 1: What factors should be considered when developing a trading strategy for Nikkei 225 Futures?

To develop an effective trading strategy for Nikkei 225 Futures, it is crucial to consider market trends, economic indicators, geopolitical events, and technical analysis. By monitoring these factors and identifying patterns, traders can make informed decisions that align with the market's direction.

Question 2: What are some common technical indicators used in Nikkei 225 Futures trading?

Technical indicators commonly employed in Nikkei 225 Futures trading include moving averages, Bollinger Bands, Relative Strength Index (RSI), and Ichimoku Cloud. These indicators provide insights into market momentum, volatility, and potential trading opportunities.

Question 3: How does market sentiment impact Nikkei 225 Futures trading?

Market sentiment plays a significant role in Nikkei 225 Futures trading. A positive market sentiment, characterized by bullishness and optimism, typically leads to increased demand for futures contracts, resulting in higher prices. Conversely, negative sentiment leads to decreased demand and lower prices.

Question 4: What are the key risk management strategies for Nikkei 225 Futures trading?

Effective risk management is essential in Nikkei 225 Futures trading. Strategies include setting stop-loss orders to limit potential losses, using proper position sizing to manage risk exposure, and diversifying portfolio holdings to reduce overall risk.

Question 5: How can fundamental analysis enhance Nikkei 225 Futures trading?

Fundamental analysis, which involves assessing economic data, industry trends, and corporate earnings, provides valuable insights that complement technical analysis. By understanding the underlying factors driving market movements, traders can make more informed decisions.

Question 6: What resources are available to support Nikkei 225 Futures traders?

Traders have access to a range of resources to enhance their Nikkei 225 Futures trading experience. These include market news, technical analysis tools, trading simulators, and educational platforms. By utilizing these resources, traders can stay informed and improve their trading strategies.

In conclusion, understanding the nuances of Nikkei 225 Futures trading requires a comprehensive approach that encompasses market analysis, technical indicators, risk management, and fundamental analysis. By addressing common questions and misconceptions, this FAQ section provides a valuable resource for traders of all levels.

Transitioning to the next article section on advanced trading techniques for Nikkei 225 Futures...

Tips

This section provides a concise overview of the key strategies and analytical techniques employed in the Nikkei 225 Futures: Trading Strategies And Market Analysis. These tips aim to enhance understanding and facilitate successful trading in the Nikkei 225 futures market.

SGX Launches Nikkei 225 Climate PAB Futures - Source www.orientfutures.com.sg

Tip 1: Develop a thorough understanding of the Nikkei 225 Index, including its composition, weighting, and historical performance. This knowledge provides a foundation for comprehending the dynamics of the Nikkei 225 futures market.

Tip 2: Utilize technical analysis techniques to identify trading opportunities and assess market trends. Employ indicators such as moving averages, support and resistance levels, and candlestick patterns to gain insights into price action and potential market reversals.

Tip 3: Incorporate fundamental analysis to evaluate the economic and geopolitical factors that influence the Nikkei 225 Index. Monitor macroeconomic data, corporate earnings, and political developments to gain a comprehensive understanding of market sentiment and potential price fluctuations.

Tip 4: Implement robust risk management strategies to mitigate potential losses. Utilize stop-loss orders, position sizing, and diversification techniques to manage risk and protect trading capital.

Tip 5: Understand the psychology of trading and its impact on decision-making. Develop emotional discipline, avoid impulsive trades, and maintain a level-headed approach to navigate market volatility and achieve long-term success.

By adhering to these tips, traders can enhance their comprehension of the Nikkei 225 futures market, refine their trading strategies, and improve their overall trading performance.

These tips serve as a stepping stone towards a more in-depth exploration of the Nikkei 225 Futures: Trading Strategies And Market Analysis. Through continued learning and practical application, traders can gain a competitive edge in the dynamic and ever-evolving Nikkei 225 futures market.

Nikkei 225 Futures: Trading Strategies And Market Analysis

Understanding the intricacies of Nikkei 225 futures trading requires examining key aspects such as market trends, technical indicators, risk management strategies, fundamental analysis, and sentiment analysis.

- Market Trends: Identifying overall market direction for informed trading decisions.

- Technical Indicators: Utilizing charts and patterns to forecast price movements.

- Risk Management: Establishing stop-loss orders and position sizing to mitigate losses.

- Fundamental Analysis: Assessing economic and corporate factors influencing market behavior.

- Sentiment Analysis: Gauging market sentiment through news and social media to identify potential turning points.

- Trading Strategies: Developing specific trading plans based on market conditions, risk tolerance, and profit targets.

These aspects are interconnected, with market trends and technical indicators providing insights for trading strategies. Fundamental analysis and sentiment analysis offer context for market movements, while risk management safeguards capital. Combining these elements enables traders to navigate the dynamic Nikkei 225 futures market effectively.

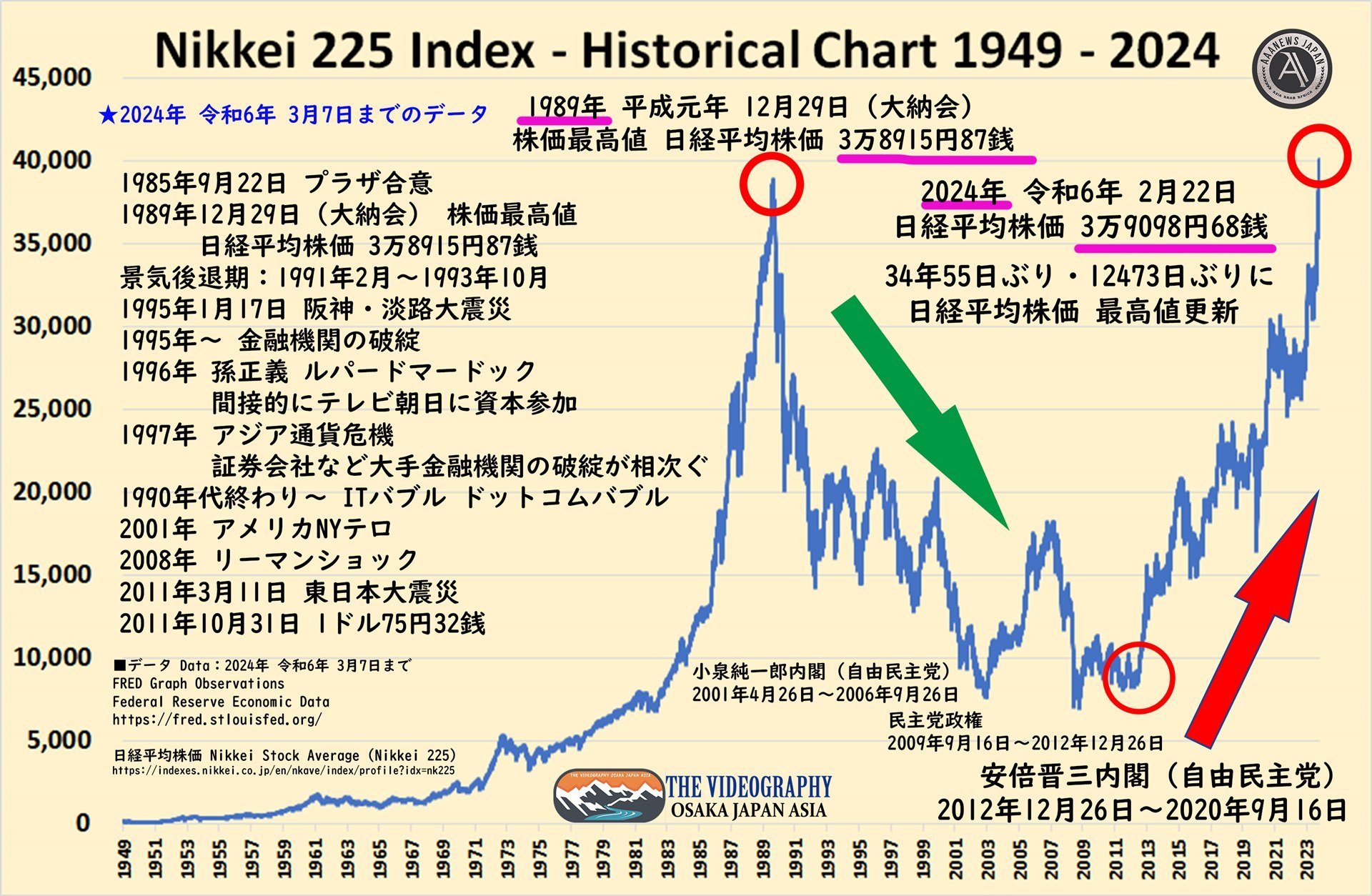

Nikkei 225 Index Historical Chart 1949 - 2024・日経平均株価 - Source videographyosaka.com

Nikkei 225 Futures: Trading Strategies And Market Analysis

The Nikkei 225 is a stock market index that tracks the performance of 225 of the largest companies listed on the Tokyo Stock Exchange. It is one of the most widely followed stock market indices in Asia and is used as a benchmark for the performance of the Japanese economy. Nikkei 225 futures are contracts that allow traders to speculate on the future price of the Nikkei 225 index.

Japan’s Lost Decades: 30 years of negative returns from the Nikkei 225 - Source investguiding.com

There are a number of different trading strategies that can be used to trade Nikkei 225 futures. Some of the most popular strategies include:

- Trend following: This strategy involves buying Nikkei 225 futures when the index is trending up and selling them when the index is trending down.

- Mean reversion: This strategy involves buying Nikkei 225 futures when the index is below its historical average and selling them when the index is above its historical average.

- Range trading: This strategy involves buying Nikkei 225 futures when the index is near the bottom of a trading range and selling them when the index is near the top of a trading range.

The best trading strategy for you will depend on your individual risk tolerance and trading style. It is important to do your own research and understand the risks involved before trading Nikkei 225 futures.

Practical Significance

Understanding the connection between Nikkei 225 futures and market analysis is essential for successful trading. By analyzing the market, traders can identify trading opportunities and make informed decisions. This can help them to minimize their risk and maximize their profits.

Real-Life Examples

There are many real-life examples of traders who have used Nikkei 225 futures to make a profit. One example is the trader George Soros, who used Nikkei 225 futures to make a profit of over $1 billion in 1992.

Challenges

There are a number of challenges associated with trading Nikkei 225 futures. One challenge is that the market can be volatile, which can make it difficult to predict the future price of the index. Another challenge is that Nikkei 225 futures are traded on margin, which means that traders can lose more money than they have invested.

Conclusion

Nikkei 225 futures are a powerful tool that can be used to trade the Japanese stock market. By understanding the connection between Nikkei 225 futures and market analysis, traders can identify trading opportunities and make informed decisions. This can help them to minimize their risk and maximize their profits.

However, it is important to remember that there are also a number of challenges associated with trading Nikkei 225 futures. Traders should be aware of these challenges and take steps to mitigate them before trading.